Wien Energie and the wild markets

“Wien Energie: This is how billions were gambled away”, the sensation-hungry boulevards are overflowing with headlines. “Wien Energie secures the supply of electricity, gas and heat for a city of millions. Speculation has no place in this,” counters the company, trying to reassure. How does Gutmann's Chief Investment Office interpret the situation? In a Gutmann Viewpoint Special, we take a closer look at the issue that is currently affecting us all.*

Our most valuable asset is the trust of our clients. The security of their portfolios is our top priority. I have therefore given clear instructions to my team with regards to the upheavals on the energy markets: It is not about profiting from them, but about protecting our customers from harm. Because when war meets political intervention, today's forecasts are tomorrow's waste paper.

The good news is that we are heavily invested in companies that can set their own prices and have low capital intensity. Concretely, we have hardly any investments in European utilities, which have the swords of Damocles hanging over their heads: excess profit taxation and other political interventions.

Futures: A curse and a blessing at the same time

What actually happened at Wien Energie? I remember sitting in the offices of a hedge fund in New Jersey decades ago. Wide-eyed, I listened to the stories about the wild beast of electricity trading, as the price not only fluctuated wildly, but could even become negative.

Since even the price of oil traded at a negative price in April 2020, we are all more familiar with this paradoxical situation. Electricity traders at the time probably just shrugged their shoulders and said, “Been there, done that.” That is because electricity has to go somewhere, and when storage facilities are full, producers have to pay to be allowed to deliver at all.

However, in the current situation, the exact opposite is the case. Gas and electricity are in short supply and prices are skyrocketing.

Let us look back at the past: farmers have always faced high fluctuations in grain prices. What to do if the traded price is attractive in summer but collapses after the harvest in autumn? Would it not be better to sell autumn forward in summer?

This gave rise to the Dojima Rice Exchange in Japan in 1730, the world's first trading center for forward transactions in rice. It was followed in 1848 by the Chicago Board of Trade, the first commodity exchange in the USA. In the 1970s, the first exchanges for financial futures were founded.

Back then, farmers already learned that hedging transactions also have their pitfalls. If you sell the future harvest months before it is harvested, a lot can happen. A storm can destroy the hoped-for harvest. What now? How to fulfill the deal that was made? Or maybe the price of the grain rises sharply. The farmer thinks to himself, no problem, I have already completed my selling price, it is therefore only a lost additional profit. The awakening comes when the futures exchange knocks on his door and wants more collateral.

This is because, from the point of view of the exchange, the farmer does not yet have the grain. He sells with the intention of actually physically delivering the traded quantity. In fact, he has sold short in the eyes of the exchange. The exchange has to make sure that the buyer of the contract has a solvent counterpart. Therefore, it will demand higher collateral from the short seller when prices rise.

Boomerang short selling

Wien Energie writes in its press release of August 30, 2022 (marks by the author):

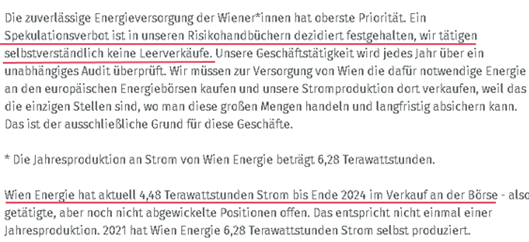

Source: Wien Energie press release

The underlined part says, “A ban on speculation is firmly laid down in our risk manuals, and it goes without saying that we do not engage in short selling.” and, “Wien Energie currently has 4.48 terawatt hours of electricity for sale on the exchange until the end of 2024 - i.e. positions that have been taken but not yet settled.”

I assume that Wien Energie has been using forward contracts of this type for many years. As outlined above, the electricity price fluctuates so much that even negative prices are possible. It is totally understandable to partially hedge one's own production, allowing to provide more price certainty and stability, also vis-à-vis the end customer.

However, the exchange does not care. From their point of view, electricity volumes have been sold in advance until 2024 and they must ensure that every contract is fulfilled. For this reason, it demands additional collateral in the event of price increases.

I could imagine that Wien Energie's risk management works with different models and analyzes different scenarios. With an electricity price of 50 euros per megawatt hour (e.g., at the beginning of 2021), extreme scenarios were certainly taken into account and probability-weighted. In practice, however, markets have once again shown that they know no physical boundaries. The current scenario of electricity prices of 1,000 euros was probably outside the model assumptions.

Many years ago, when Warren Buffett was looking for a co-manager for Berkshire Hathaway's stock portfolio, he said the following:

“Over time, markets will do extraordinary, even bizarre, things. A single, big mistake could wipe out a long string of successes. We therefore need someone genetically programmed to recognize and avoid serious risks, including those never before encountered. Certain perils that lurk in investment strategies cannot be spotted by use of the models commonly employed today by financial institutions.”

We investors are always risk managers, and that includes thinking about things we have never experienced before. Currently, participants in the energy market are learning this wisdom the hard way.

The intricacies of the electricity market are complex and outside our core competence. However, as a former futures trader, I understand the basic mechanisms. I am happy to discuss the technical details with you, and even more happy to learn if you have discovered a thinking error.

*For our non-Austrian readers, Wien Energie is Austria’s largest energy provider that has been in the news recently, needing financial support from the government.

Do you like this article?

Subscribe to our newsletter and stay up to date.

Newsletter subscriptionStay informed.

Learn more about Gutmann and our investment strategy.

Gutmann Journal