Strategic Duration For Your Portfolio

Remember 5-year bonds from solid issuers with a 5% coupon and yield? It was more than 15 years ago, then as now a classic issue. But then came the Global Financial Crisis in 2008 and the zero-interest rate environment followed on its heels. After that, such securities were merely wishful thinking and not available in the euro area.

Today, we are close to this level again. As such, 5-year corporate bonds from solid issuers are available with a yield of over 4% per year. However, what does solid mean here? There is a hard technical limit for this, which is called “investment grade,” known in the market technical jargon. This term summarizes issuers with good to very good credit ratings. Rating agencies assign the grades, in this case BBB or better (rating details can be found at the end of the article).

The obvious counterargument to the supposed attractiveness of these bonds: “Inflation is at 8% in Europe. With a time span of 5 years, therefore, 4% is not enough for me.” Nevertheless, the market is not reflecting current inflation figures, it is reflecting the future. Annual inflation is expected to be 2.3% over the next 5 years. These are not survey figures, but prices currently traded on the market. If it actually comes to that, positive real returns are possible again. Therefore, the money invested will also increase in inflation-adjusted terms.

Gutmann’s Tactical Engagement?

The Gutmann Global Bonds strategy was at a duration of 3.2 years at the beginning of 2022. Due to the zero-interest rate environment, we wanted to lend the money only for the short term - which is what buying a bond is all about. Duration is a measure of interest rate risk. It tells us how long the capital is tied up on average before we can dispose of it again. Gutmann has set itself a range of between 3 and 6 years. The strategic orientation is for a duration of 4.5 years. This figure is no coincidence; it corresponds to approximately a 5-year bond. For those who love technical details, the exact figure also depends on the coupon rate and the prevailing market interest rate.

This month, we raised the duration in the Gutmann Global Bonds strategy to 4.5 years. For us, bonds are attractive enough again to bring them back into the portfolio with a strategic duration. The difference between 3.2 and 4.5 years over the last 14 months shows that active management in well-considered small steps, leading to a noticeable repositioning over time. This active management is superior to a buy-and-hold strategy, as a buy-and-hold equates to buying securities and keeping them unchanged in the portfolio over the long term. For example, one buys a 5-year bond and waits until it is redeemed at maturity in 2028. In 2025, however, it only has a remaining term of 3 years. At that point, might it be better to hold much longer maturities in the portfolio? Investors thus become passive passengers of their own investments.

No one can predict the market development over the next few years. But one thing is certain: The Gutmann investment team always focuses your portfolio on the best opportunities. Always with a long-term view of the future.

Excursus: The rating of the agencies

Rating agencies use a rating scale to classify the creditworthiness of companies and countries. They thus decide on their financing conditions, because investors all over the world are guided by them. The best-known rating agencies are Standard & Poor's, Moody's and Fitch.

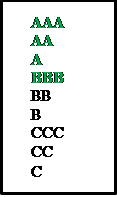

Here is an example:

Ratings highlighted in green are investment grade, i.e. debtors with a low probability of default. The remaining ratings are called high-yield bonds. AAA or triple-A is the best rating - only a few companies can still boast of this. In the USA, only Microsoft and Johnson & Johnson are in this category. Among countries, there are a few, including our neighbors Germany and Switzerland. Austria is only just behind with AA+. Vacation favorite Italy, by the way, is at BBB.

The required data for disclosure in accordance with Section 25 Media Act is available on the following website: https://www.gutmann.at/en/imprint

Do you like this article?

Subscribe to our newsletter and stay up to date.

Newsletter subscriptionStay informed.

Learn more about Gutmann and our investment strategy.

Gutmann Journal