Quarterly Report

Gutmann Portfolio Management Report

Q2 2023

Actively letting profits run.

Share prices have climbed the wall of worry in the first half of the year. Thanks to our disciplined process, we participated above average in this rise. The portfolios continue to be positioned to seize opportunities without taking concentration risks.

You find a short version of the decisions we have made in Gutmann Portfolio Management and our market assessments below, or click on the download link to read the quarterly report in full in PDF format.

You find a short version of the decisions we have made in Gutmann Portfolio Management and our market assessments below, or click on the download link to read the quarterly report in full in PDF format.

- Increases of share prices.Advent of a new bull market.After last year's resilience, high-dividend stocks have been in little demand so far this year. Their performance lagged behind those of broad-based stock indices. Overall, the performance was nevertheless pleasing.

- New rules of the game in Japan.Changes on the stock exchange.The Tokyo Stock Exchange requires companies whose stock market value is below their book value to take targeted measures to increase their value. The companies themselves have become increasingly shareholder-friendly in recent years.

- Falling interest rates ante portas?Cycle of interest rate hikes continues.Financial markets expect interest rates to fall over the next 2 years. Swarm intelligence cannot predict the economic conditions of 2024 and 2025. We position our bond portfolio not on the basis of economic expectations, but on the basis of current opportunities and risks.

The Artificial Intelligence revolution.

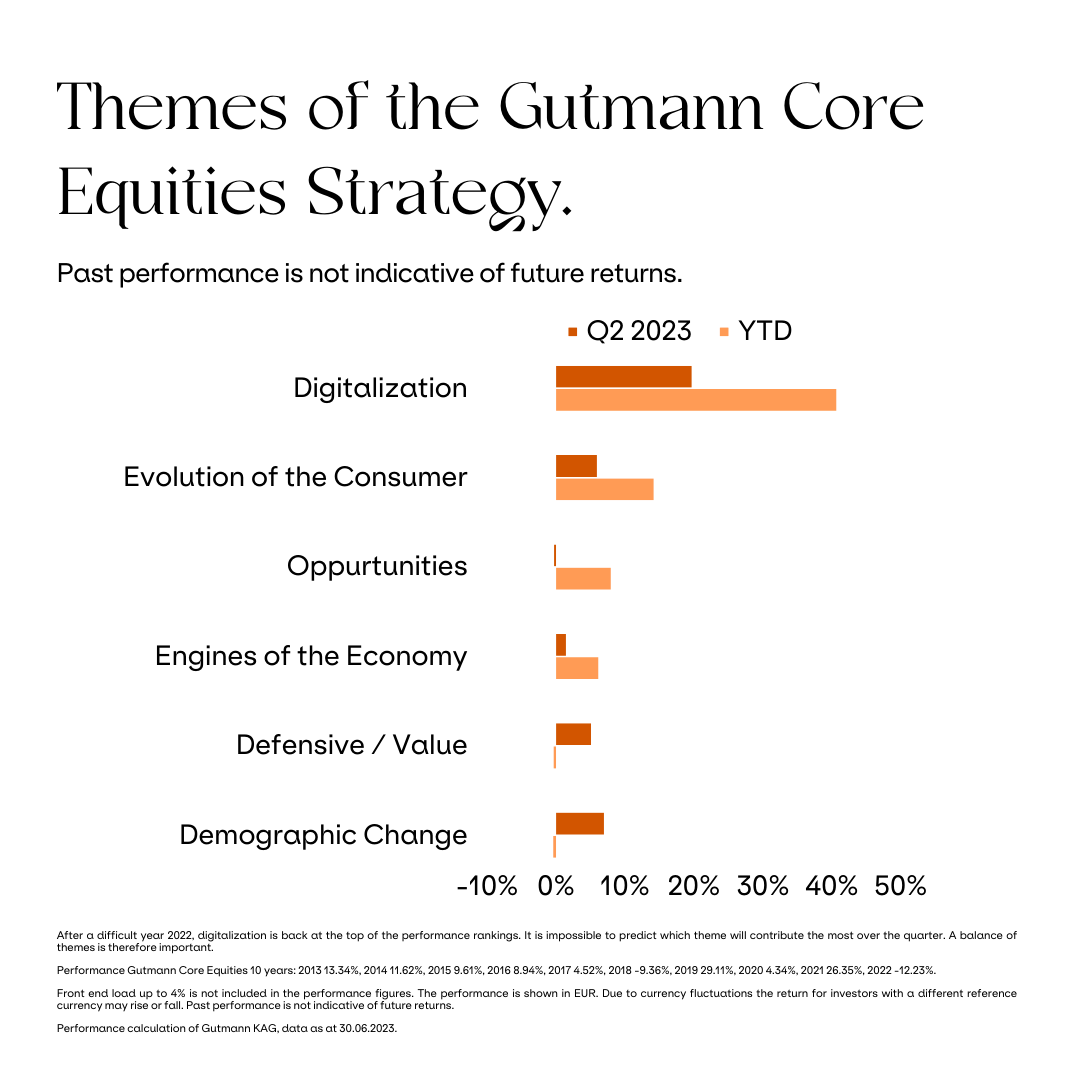

The most important performance driver as of May was digitalization. True to the motto "The last shall be first", it jumped from the bottom of the 2022 returns ranking to the top in 2023. You may have already guessed what the trigger was: artificial intelligence. It especially fired up the company Nvidia, the world leader in chips essential for the training and computation of artificial intelligence applications. The prices of the other stocks we selected in the digitalization theme also rose sharply. Is it now time to take profits and part ways with stocks from the digitalization segment?

Indeed, some stocks currently hold ambitious valuations, and large positions bring about corresponding concentration risks. However, the active management of these risks is built into our investment process.

Indeed, some stocks currently hold ambitious valuations, and large positions bring about corresponding concentration risks. However, the active management of these risks is built into our investment process.

Change in currency mix.

Important changes have been evident in Japan for some time now. The Tokyo Stock Exchange requires companies whose stock market value is below their book value to take targeted measures to increase their value. The companies themselves have become increasingly shareholder-friendly in recent years.

So, in 2022, repurchases of own shares increased by 40% compared to the year before, marking new record levels. This development is likely to continue in 2023. Our strategy in Japan is based on two main drivers. On the one hand we have strongly undervalued shares with a solid and profitable core business. On the other hand we have international champions that are often market leaders in promising areas such as digitalization, automation, and electromobility. With 3,880 listed companies, the Japanese stock exchange is one of the world's largest stock markets.

We have actively changed the currency composition of the Gutmann equity strategy. For a number of years, 30% of the U.S. dollar was hedged against the euro for euro investors in equities. In February 2022, we reduced this hedge to 25%. Then, in mid-April 2023, we took a further step and reduced it to 15%. Since 60% of the Gutmann equity strategy is invested in the U.S., this means 51% U.S. dollar risk. The companies we select are increasingly active internationally, which is why currency hedging is becoming less relevant. In a single year, a very strong or very weak dollar may have an impact on performance. In the long term, however, we expect little impact. As a matter of fact, investors who think in U.S. dollars do not have currency hedges in their portfolios.

So, in 2022, repurchases of own shares increased by 40% compared to the year before, marking new record levels. This development is likely to continue in 2023. Our strategy in Japan is based on two main drivers. On the one hand we have strongly undervalued shares with a solid and profitable core business. On the other hand we have international champions that are often market leaders in promising areas such as digitalization, automation, and electromobility. With 3,880 listed companies, the Japanese stock exchange is one of the world's largest stock markets.

We have actively changed the currency composition of the Gutmann equity strategy. For a number of years, 30% of the U.S. dollar was hedged against the euro for euro investors in equities. In February 2022, we reduced this hedge to 25%. Then, in mid-April 2023, we took a further step and reduced it to 15%. Since 60% of the Gutmann equity strategy is invested in the U.S., this means 51% U.S. dollar risk. The companies we select are increasingly active internationally, which is why currency hedging is becoming less relevant. In a single year, a very strong or very weak dollar may have an impact on performance. In the long term, however, we expect little impact. As a matter of fact, investors who think in U.S. dollars do not have currency hedges in their portfolios.

Higher interest income.

We don't have a crystal ball either, and with a duration of 4.5 years and different bond segments, we position ourselves light-footed enough to react to changes in the interest rate landscape. You can look at bond portfolios in a variety of ways. But two trends are clearly evident in the Gutmann strategy: Maturities are longer than they were a year and a half ago, and quality has been enhanced by higher ratings and additional security from covered bonds. And so, the current interest income is significantly higher than it was before the interest rate turnaround. In addition, the portfolio has a higher interest rate sensitivity. If, unexpectedly, there is a sharp economic slowdown or turmoil on the financial markets, the bond component again provides the desired additional security as a counterweight to the equity component. Thus, bonds fulfill the diversification role in mixed portfolios, something they have not been able to provide for many years.

The Gutmann bonds strategy bottomed out in October 2022. Since then, we have been in a narrowing sideways movement.

Solide Renditen brauchen Zeit.

Presently, there is talk of high stock valuations in the hh face of rising interest rates. We keep all the relevant variables of the financial markets firmly in view. However, it is not enough for us to just scratch the surface. If you remove stocks with the largest weightings from indices, the valuation of the rest of the market is really cheap. This is also reflected in the global Gutmann equity strategy, where the valuation is unremarkable compared to the last 5 years. We search for, analyze, and buy individual stocks and bonds that promise attractive returns over the next few years for our portfolio management clients. We actively follow individual business models and compare company results with our expectations. This is not always visible as activity in the portfolios. But as the successful U.S. investor Charlie Munger once said: “The big money is not in the buying and selling, but in the waiting." Waiting, remaining optimistic, and being invested in the financial markets have brought good results for us so far this year. The second half of the year may bring a correction. In fact, it would even be expected. But that does not change our long-term strategy of investing in attractive securities.

Please contact us today if you have any questions.

Gutmann Information

Do you have questions?

- We will be happy to answer your questions and help you with your concerns. Please contact the private clients team or send an e-mail to portfolio-management@gutmann.at

- This is a marketing information. Investment in financial instruments respectively investment funds is subject to market risks. Past performance is not indicative of future returns. Forecasts are not necessarily indicative of future results.

Gutmann Global Bonds Strategy may invest mainly in categories of assets other than securities or money market instruments.

Due to the composition of the portfolio and the used portfolio management techniques the Gutmann Core Equities, Gutmann Global Dividends, Gutmann Pure Innovation and the Nippon Portfolio under certain circumstances can show an increased volatility, i.e. the value of units may be exposed to high up- and downturns within short periods of time.

Further Information on the main risks of the Fund can be found in the Key Information Document ("PRIIPs-KID") as well as the prospectus or the information for investors pursuant to Article 21 German Act on Alternative Investment Fund Managers (AIFMG - Alternatives Investmentfonds Manager-Gesetz) under the item "Risk profile of the Fund".

The Funds pursue an active management strategy without reference to a benchmark.

All figures made without guarantees. Errors and omissions excepted.

For interested parties the Key Information Document (“PRIIPs KID“) in accordance with the Regulation (EU) No 1286/2014 for Nippon Portfolio, Gutmann Global Bonds Strategy, Gutmann Core Equities, Gutmann Global Dividends and Gutmann Pure Innovation respectively the prospectus in accordance with section 131 InvFG for Nippon Portfolio, Gutmann Core Equities, Gutmann Global Dividends and Gutmann Pure Innovation respectively the Information for investors according to section 21 AIFMG for Gutmann Global Bonds Strategy in their current versions are provided in German language free of charge at Gutmann KAG and Bank Gutmann AG, both Schwarzenbergplatz 16, 1010 Vienna, Austria and on the Website www.gutmannfonds.at as well as for Nippon Portfolio, Gutmann Core Equities and Gutmann Global Dividends at the German information center Dkfm. Christian Ebner, Attorney at Law, Theresienhöhe 6a, 80339 Munich as well as for Nippon Portfolio at the Dreyfus Söhne & Cie AG, Aeschenvorstadt 14-16, 4002 Basel. The distribution of fund units was notified to the German Federal Financial Supervisory Authority (BaFin). Gutmann KAG may de-notify the distribution of funds in Germany as far the conditions according to Art 93a of Regulation 2009/65/EG are fulfilled.

Further information on the sustainability-relevant aspects of the Fund can be found at www.gutmannfonds.at/gfs.

This information has been created by Bank Gutmann AG, Schwarzenbergplatz 16, 1010 Vienna. Bank Gutmann AG hereby explicitly points out that this document is intended solely for personal use and information. Publishing, copying or disclosure by any means whatsoever shall not be permitted without the consent of Bank Gutmann AG. The contents of this document have not been designed to meet the specific requirements of individual investors (desired return, tax situation, risk tolerance, etc.) but are of a general nature and reflect the current knowledge of the persons responsible for compiling the materials at the copy deadline. This document does not constitute an offer to buy or sell nor a solicitation of an offer to buy or sell securities. Information to investor rights is available on the website www.gutmannfonds.at/gfs and are provided on request in German language at Gutmann KAG and Bank Gutmann AG.

The required data for disclosure in accordance with Section 25 Media Act are available on the following website: https://www.gutmann.at/en/imprint.