Clear Words From The Very Top.

Robert Karas

Chief Investment Officer | Partner

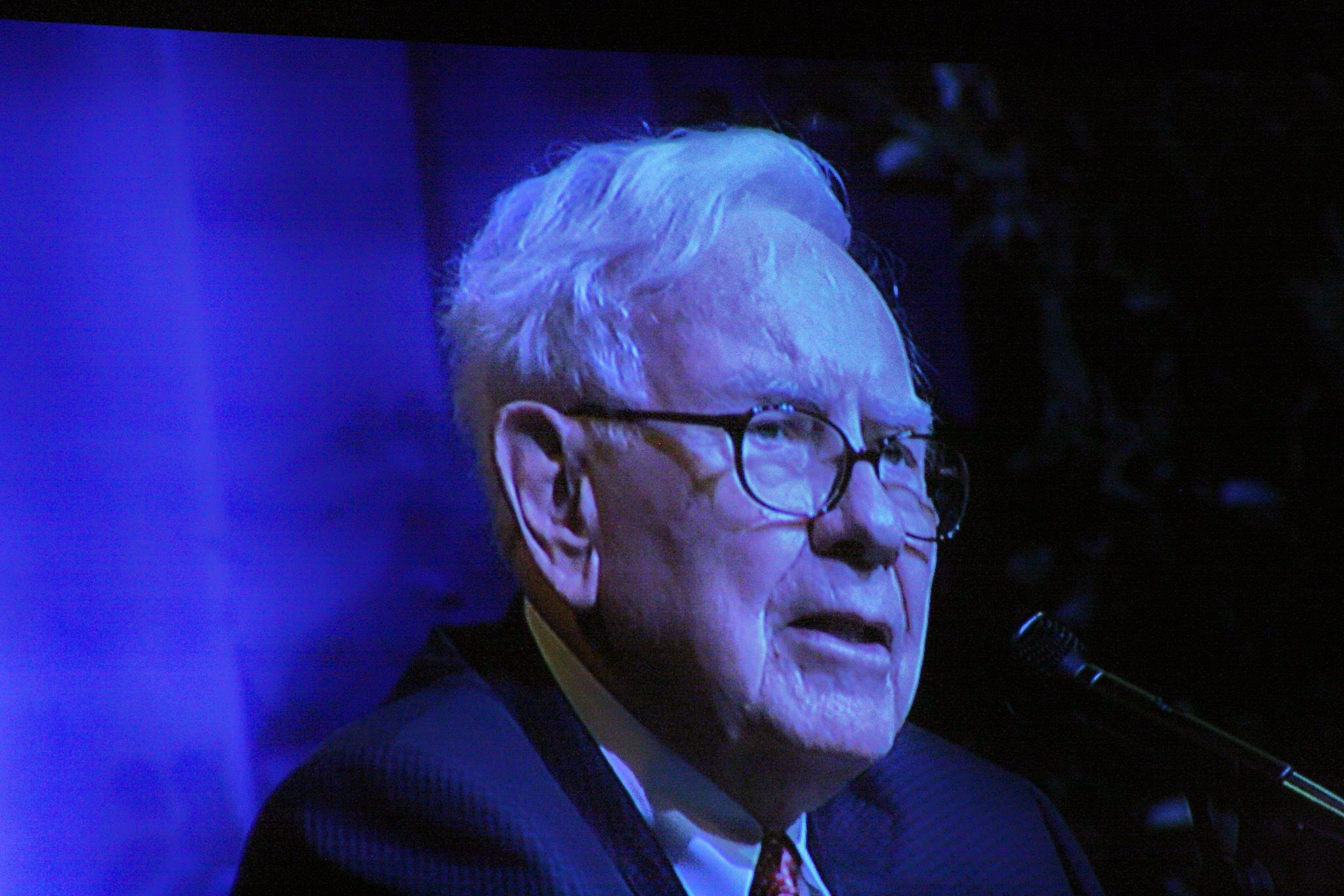

Every year, at the end of February, Warren Buffett's shareholder letter is published. While writing it, he thinks of his sisters Doris and Bertie. Intelligent ladies, but not experts in accounting and finance. Doris passed away in 2020, but the idea still holds true. He thus ensures that the two of them have all the information he would need if the positions were reversed (should you not have appropriate relatives, just borrow Buffet's two sisters). It helps him not to fall into an extreme financial jargon, which probably many readers would also find difficult to understand.

Buffett's style of writing has not gone unnoticed. In 1998, the U.S. Securities and Exchange Commission SEC published a highly recommended reading entitled “A Plain English Handbook. How to create clear SEC disclosure documents.” Even the top regulator is interested in making sure that shareholders can actually understand company documents. The foreword to this comes from Warren Buffett. He describes how he approaches the matter:

Gutmann is committed to clear and transparent communication. If you ever don't understand what your asset manager writes to you, don't blame yourself. Between you and me, a lack of clarity and transparency is often a protective wall to hide your own insecurities.

All Berkshire Hathaway articles

Here you can find all blog posts by Robert Karas

Overview